Thailand Casinos Inch Closer to Reality, Could Open before MGM Osaka

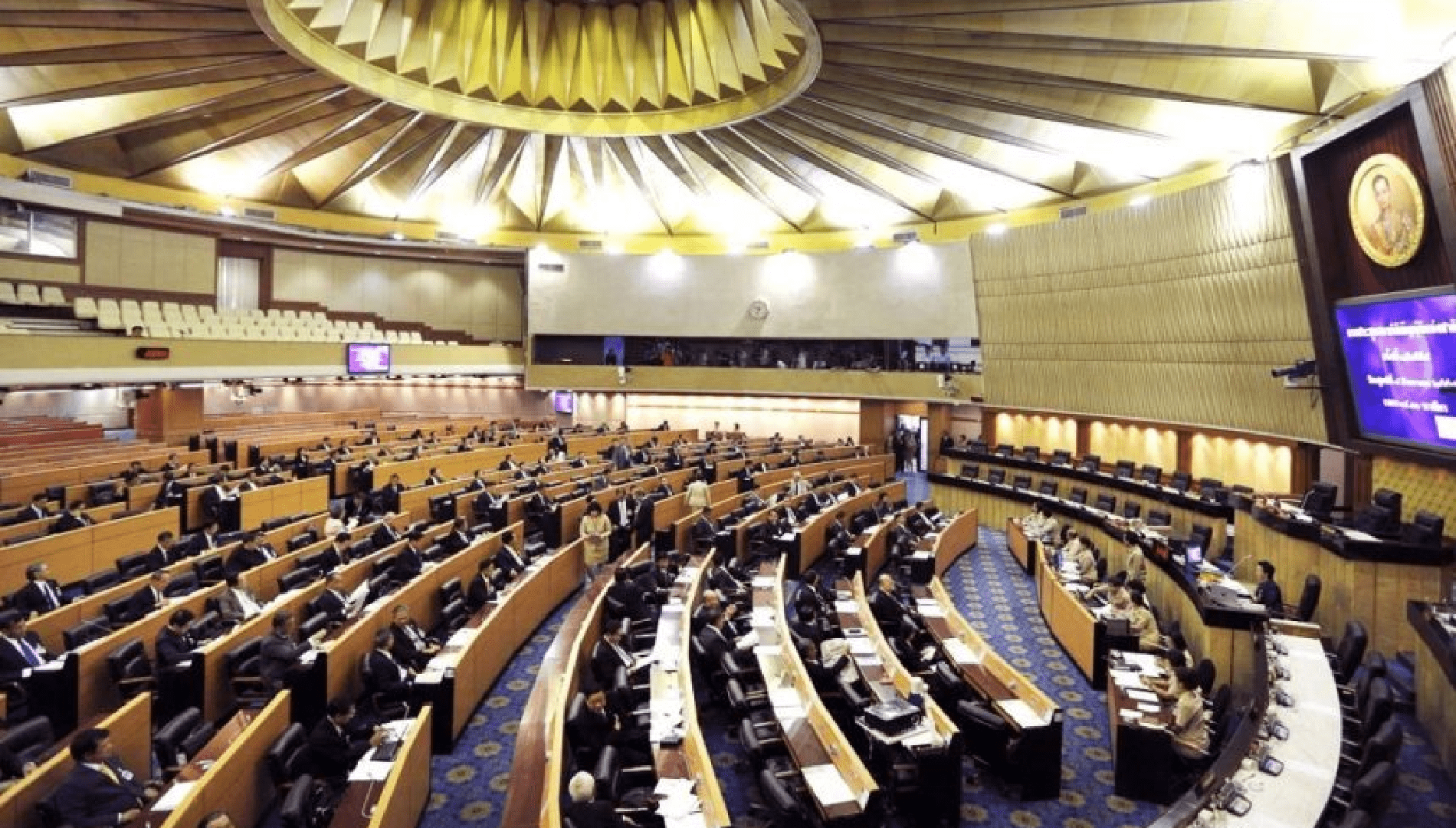

With the easy passage of legislation enabling entertainment complexes, which would include gambling venues, by the House of Representatives on Thursday, Thailand is moving closer to legalizing casino resorts.

253 of the 257 House members present cast votes in support of the measure pertaining to casino gaming. The cabinet of the national government could soon get a feasibility assessment on casinos, according to Deputy Finance Minister Julapun Amornvivat. If the pace keeps up, it's feasible that Thailand's first casino will open its doors ahead of MGM Resorts International's (NYSE: MGM) integrated complex in Osaka. 2030 is when the first casino hotel in Japan is anticipated to open.

"Assuming two years to finalise a regulatory framework and three years to construct, the first entertainment centre may only open in 2029 (in Thailand),” said Maybank Investment Bank in a note to clients today.

Should Thailand’s national cabinet formally approve entertainment complexes, it’s possible that up to eight such venues will be permitted and it’s likely that awarding of gaming licenses will occur in phases.

Thailand Casinos Could Beat Japan Efficiency, Emulate Singapore Model

Owing to its reputation as major tourist destination in Southeast Asia and its penchant for attracting visitors from China and the West, Thailand was already expected to attract some of the gaming industry’s biggest names in terms of bidding for casino permits.

That scenario could be amplified should the Thai government continue displaying efficiency in the legalization and regulatory process.

Japan only had the MGM Osaka location to begin its transition into casino gambling when so many of the biggest operators in the business finally gave up on the country due to delays and a lack of clarity on those fronts.

Additionally, analysts predict that Thailand's casino laws would resemble those of Singapore rather than Macau, and that the country's low tax rates may entice foreign operators even more.

"Social safeguards à la [in the manner of] Singapore will be proposed, and proposed gaming tax rates are low at 17%," Maybank analysts pointed out.

There are just two integrated resorts in Singapore, both owned and run by Genting Singapore, a division of Las Vegas Sands (NYSE: LVS).

Additional Information About Thailand Casinos

If Thailand were to continue with its current 17% gross gaming revenue (GGR) tax rate, it would have the second-lowest casino taxes in the region, only surpassed by Cambodia. Operators may also prefer the anticipated 20-year license durations with the option of renewals every five years. It's also been discussed that the highest required investments might fall between $2.5 and $3 billion, which is comfortably within reach for any number of operators considering Thailand.

According to Maybank, the Thai government probably prefers that the first entertainment complexes be built in some of the 13 preferred places in the eastern, northern, northeastern, and southern regions of the nation. A committee to review casino offers will be led by the prime minister of the nation.

Thai entertainment centers with casinos are predicted to increase traveler spending in the nation by up to 52% a year. This is one of the reasons why some of the biggest brands in the gaming business are expected to make bids for the nation.